Understanding AR Invoice Processing: A Comprehensive Guide

Automated Receivables Invoice Processing (AR Invoice Processing) has revolutionized the way businesses manage their financial operations. By automating the traditionally manual process of invoice handling, companies can streamline their workflows, reduce errors, and save time. In this detailed guide, we will explore the various aspects of AR Invoice Processing, its benefits, and how it can transform your business.

What is AR Invoice Processing?

AR Invoice Processing refers to the automated handling of incoming invoices from customers. It involves the capture, validation, approval, and payment of invoices, all of which are done without manual intervention. This process is designed to eliminate the need for paper-based documentation and reduce the chances of errors that often occur in manual processing.

Key Components of AR Invoice Processing

AR Invoice Processing typically consists of the following components:

| Component | Description |

|---|---|

| Invoice Capture | The process of capturing invoice data, either through OCR (Optical Character Recognition) or by importing electronic invoices. |

| Invoice Validation | Ensuring that the captured invoice data is accurate and matches the terms of the contract. |

| Invoice Approval | The review and approval of invoices by authorized personnel before payment is processed. |

| Payment Processing | The automated processing of payments to vendors based on approved invoices. |

| Reporting and Analytics | Generating reports and analytics to monitor the performance of the AR Invoice Processing system. |

Benefits of AR Invoice Processing

Implementing an AR Invoice Processing system offers several benefits to businesses:

-

Increased Efficiency: Automation reduces the time and effort required to process invoices, allowing your team to focus on more valuable tasks.

-

Reduced Errors: Automated systems minimize the risk of human error, ensuring accurate and timely payments.

-

Cost Savings: By reducing the need for manual labor and paper-based documentation, businesses can save on operational costs.

-

Improved Cash Flow: Faster invoice processing leads to quicker payments, which can improve your company’s cash flow.

-

Enhanced Compliance: Automated systems help ensure that your business complies with regulatory requirements and internal policies.

Choosing the Right AR Invoice Processing Solution

Selecting the right AR Invoice Processing solution is crucial for the success of your business. Here are some factors to consider when choosing a solution:

-

Scalability: Ensure that the solution can grow with your business and handle increasing volumes of invoices.

-

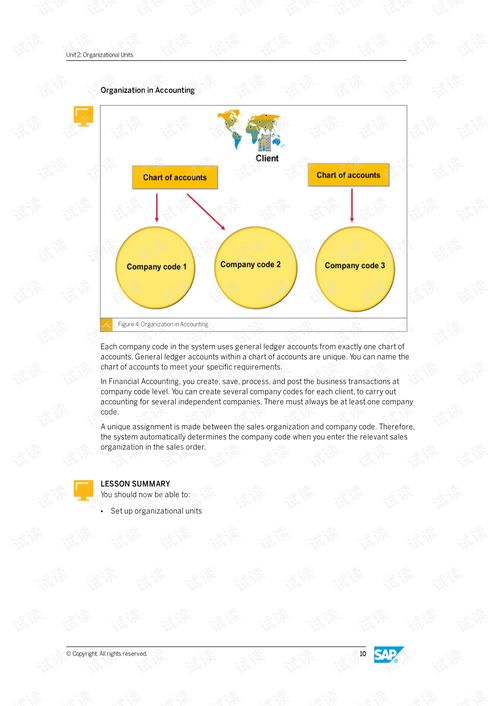

Integration: Look for a solution that can integrate with your existing accounting and ERP systems.

-

Customization: Choose a solution that allows you to customize workflows and rules to meet your specific needs.

-

Security: Ensure that the solution provides robust security measures to protect sensitive data.

-

Support and Training: Look for a provider that offers comprehensive support and training to help you get the most out of the solution.

Implementing AR Invoice Processing in Your Business

Implementing an AR Invoice Processing system requires careful planning and execution. Here are some steps to help you get started:

-

Assess your current invoice processing workflow to identify pain points and areas for improvement.

-

Research and evaluate different AR Invoice Processing solutions to find the best fit for your business.

-

Select a solution and work with your provider to customize it to your specific needs.

-

Train your team on how to use the new system and ensure they understand the new workflows.

-

Monitor the system’s performance and make adjustments as needed to optimize your invoice processing.

Conclusion

AR Invoice Processing is a powerful tool that can transform